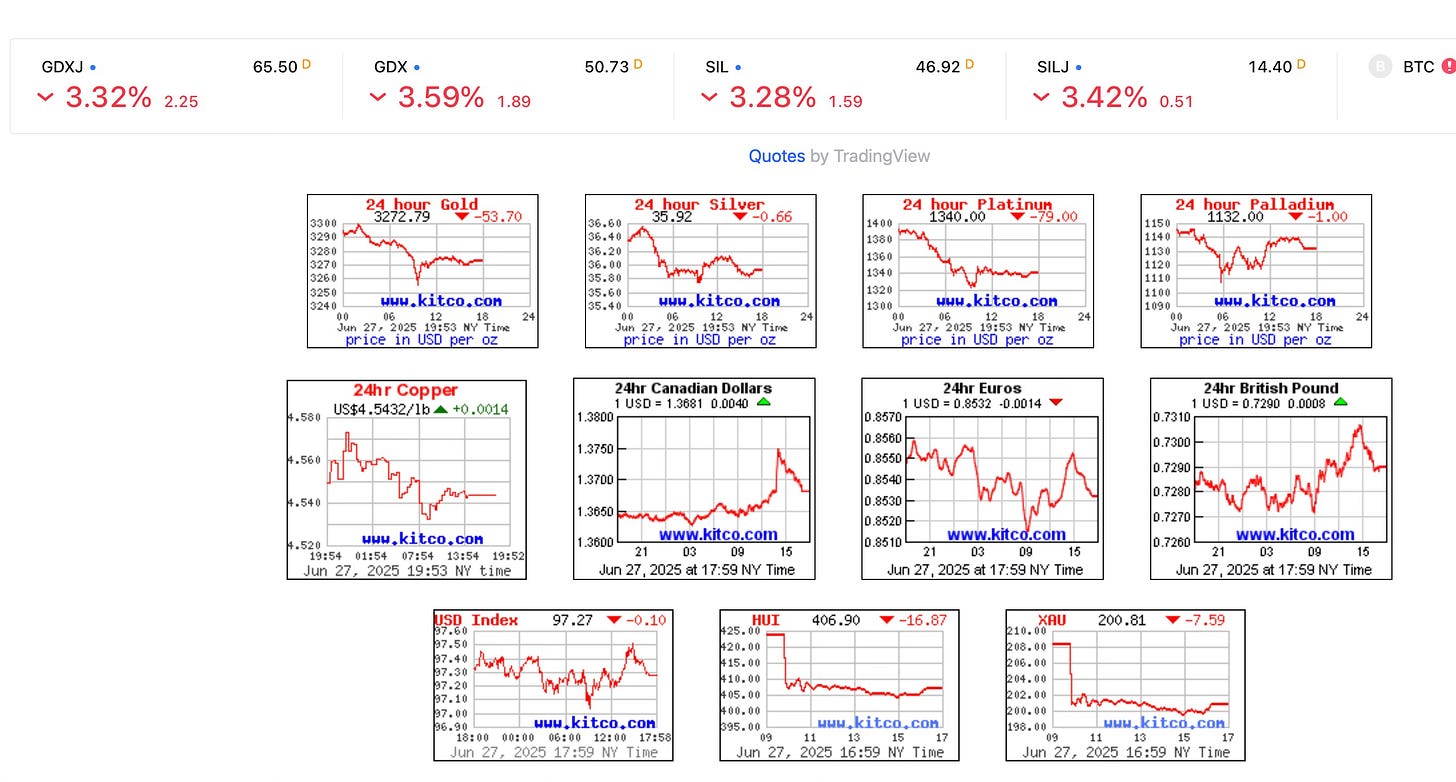

AU: $3271 ($3367- Last Week Spot)

AG: $35.86 (36.01)

HUI: 406 (421)

DXY: 97.2 (98.4)

S&P: 6173 (5967)

10-Yr: 4.27% (4.37%)

Oil: $65 (73)

We had some volatility this week. The 12-day missile tirade between Israel and Iran ended in a ceasefire after the US joined the fun. The S&P 500 thought those missiles were a good thing, sending the S&P 500 to an intra-day ATH today at 6187. While the S&P ripped higher, gold dropped $100 for the week, closing below $3300. That put the kabash on miners, with the HUI down 15 points to 406. Finally, both the DXY (97.2) and the 10-Year bond rate (4.27%) were both significantly down for the week.

So, what's next? My bet is that Trump will become embroiled in a few trade wars. Today, he announced that trade negotiations with Canada are off. Ah-oh. They are our third-largest trade partner. I doubt this will be the only trade war in July. I expect more. Tariffs are the pin that will pop the everything bubble and lead to a recession. The reason the demand for gold has been so strong is because of the US debt problem and the risk of a US recession. No one seems to remember the fear level that occurred in 2008 when we entered our last recession. It was intense. That fear is coming back, and Central Banks are front-running that outcome.

Wall Street remains bullish and continues to focus only on positive data, such as positive GDP, lower inflation, consumer spending, and employment. I just watched Ed Yardeni on MSNBC's Closing Bell. All he kept repeating was bullishness. The Judge called him John McEnroe because he kept volleying back a positive spin for any possible risk to the economy. It didn't matter who the guest was, because all the pundits are bullish right now. This is a sign of a top. Perhaps we won't get it next week, but it won't be long now. Be afraid, very afraid. When the tone flips on the economy, it is going to be ugly. Those who lose their jobs will have a hard time replacing them.

As for gold and silver, they are both in a strong position. Any dips are to be bought. We can expect to see a 5% to 10% drop in gold, and possibly more for silver and the miners. But those are shallow corrections and nothing to be worried about. Buy dips and accumulate shares. This is your last chance before the train leaves the station. From my perspective, the longer it takes to get to 450 on the HUI, the better. I'll be a buyer until we get there.

as ussual,a price smack at the end of futures expiration.

This is so common that saving cash and deploying at the end of month is working great...

Miners are down / on sale and will be back up next week.

Trumpy tariffs of 100 % if any country leaves the usd slave system mean. NO trade & thus NO tariff money and also NO factories moving to the us.

I think a massive BOYCOTT of US/Trump is coming as it makes more sense to just wait for Trumps term to run out, than to submit.

Resist and Ignore.