Summary

The author predicts that US economic growth will grind to a halt in 2024, leading to the eventual fragmentation of the country.

The 1980s Reagan administration's reliance on debt and globalism led to the current debt bubble, which will begin to pop in 2024, with huge ramifications.

The author anticipates a stock market sell-off in Q1 2024, followed by a recession and a banking crisis.

The Fed will attempt to revive the economy with rate cuts and money printing, but it won't work, signaling the end of an era.

I’ve been following the US economy closely since 1980. In my opinion, 2024 is when it stops working. Beginning next year, the US will begin to spiral downward, with the ultimate outcome leading to a nation split into several countries, and no national government.

Let me make an argument for why that prediction is correct.

From 1945 to 1970, the US was a mercantilist economy, whereby our manufacturing sector was strong, and we had a strong economy. We generated an abundance of wealth. We had a global trade surplus, low inflation, and low national debt. We were the envy of the world.

Then, in 1970, it all changed. That was the decade when we left the gold standard, inflation raged, energy prices rose, and our manufacturing base began to wane. Most importantly, it was when the middle class began to shrink, and the cost of living began to rise. The American Dream began to die for a large segment of the population.

In 1980, Ronald Reagan was elected. He gave birth to the modern Conservative movement and the death of the moderate Republican. It was the first time in American history that a modern Conservative became president. It should be noted that Donald Trump was and is despised for carrying that movement forward.

It's not only Donald Trump that is despised by Democrats, but also everything that modern Republican stands for, which Ronald Reagan gave birth. The political division and economic plight of the country all began in the 1980s.

The 1980s was a paradigm shift for American politics and the US economy. When Reagan entered office, the national debt was less than $1T, and a $100B budget deficit never occurred from 1945 to 1980. When he left office, the national debt was $2.7T, and large budget deficits above $100B were the norm, even during years of economic growth.

Reagan and his economic advisors found that debt (budget deficits) could be used to generate economic growth. Debt was recognized as a net benefit and should be utilized for the public good (economic growth). More importantly, debt was used to maintain and increase our standard of living. That economic theory/strategy persists to this day.

What Reagan promulgated was the beginning of the end for America. By relying on debt to generate economic growth, he split America apart because the use of debt only benefited the top 10% (and enormously benefited the top 1%). It did not help the lower 90% very much, and especially not the lower 50%.

In addition to relying on debt for economic growth, Reagan turned to free trade and globalism. He basically told US corporations to go make stuff in Asia and then export it back to America without any tariffs. He sped up the decline of our manufacturing base and increased the decline of the middle class and urban areas.

His Conservative policies had the effect of only working for a small slice of the American population, mostly those who were affluent. His economic team even called it trickle-down economics, which was a joke because the middle and lower classes only languished under this policy.

It should not be understated that what Reagan unleashed was the end of America, which is now playing out. He brought in globalism, which hollowed out both our manufacturing base and the middle class. He brought in a reliance on debt to maintain our standard of living and generate economic growth. He brought in a right-wing Conservative agenda that ignored the poor and middle class, pulling the country apart and making the less fortunate antagonistic toward the Republican party.

The 1990s are not understood by most. It was an era of economic growth and technological advancement. Many think this was America at its best. The Reagan policies of globalism, free trade, and trickle-down economics became entrenched. This was the era when the far-right Conservative wing of the Republican party, led by Newt Gingrich, gained strength. The Moderate wing of the party was largely purged. This had the effect of dividing the Democrats and the Republicans. They began to despise each other and could no longer find common ground.

It should also be mentioned that it was in the 1990s when the Japanese invented MMT (modern monetary theory). It is my opinion that they borrowed this idea from Reagan. It was his administration that expanded debt enormously in the 1980s. The Japanese noticed. The US recommended to the Japanese that they allow their corporations and banks to go bankrupt after their economic bubble popped in 1989. Instead, the Japanese lowered their interest rates to zero and started printing money. Their central bank (JCB) bailed out their corporations and banks, and began buying Japanese government bonds (with printed keystroke money).

The Japanese decided that if the US thinks a large national debt is okay, then it must be okay. Voila, MMT was born. Today, the Japanese national debt is over 200% of their GDP. MMT is the idea that national debt is meaningless if you have a printing press. It’s basically the same idea the Reagan economic team decided to adopt in the 1980s.

What the Japanese (and now the US) missed was that MMT is a trap. But more on that later.

While the US appeared to be doing great economically in the 1990s, our national debt and trade deficits continued to soar. We continued to rely on globalism and debt for economic growth. Consumer debt, corporate debt, and the national debt continued to climb. In fact, there seemed to be a growth correlation between all of these. America became addicted to debt. This all began in the 1980s and then carried forward to today.

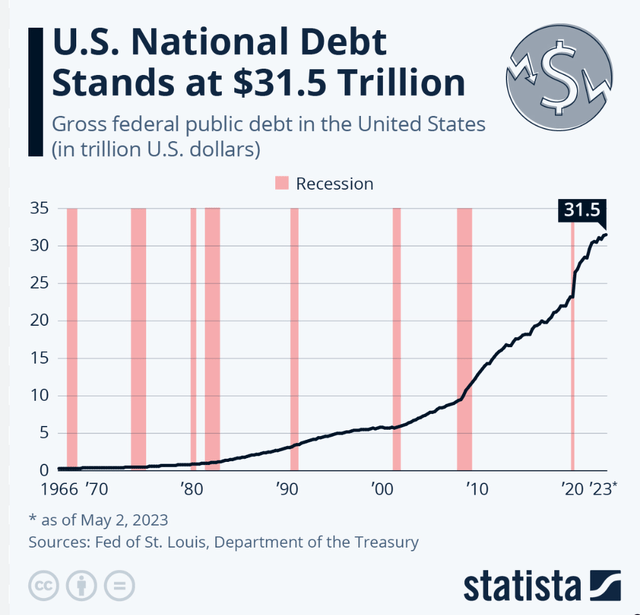

This national debt chart (see below) shows how debt began to increase in 1980 and continued thereafter. I will also include a household debt chart to show how consumers followed the government's lead in adding debt. Note that corporations did the same thing.

Once the dot-com bubble popped in 1999 and then 9/11 occurred in 2001, our debt addiction started to become a problem. The debt bubble was starting to pop. Ben Bernanke, the Chairman of the Fed, used money printing and low interest rates (the Japanese MMT model) to revive the economy (see green arrow below). However, he created a housing bubble and a stock market bubble, both of which popped soon thereafter in 2008.

Once the GFC (Great Financial Crisis) erupted in 2008, the US economy began its debt death march, which is where we have arrived today. Instead of letting the free market repair itself, Hank Paulsen (Secretary of the Treasury) and Ben Bernanke followed the Japanese model and did a massive bailout using printed money and debt. Basically, they reinflated the debt bubble.

By reinflating the bubble, the Fed realized that the economy could no longer grow on its own. From now on, it would have to be manipulated. So, in 2009, they took interest rates to zero and kept them there for five years. It was a false Potemkin economy, but Americans thought the Fed was the all-powerful financial institution and could overcome any adversity.

As I write this today (December 18th), the DOW is at an ATH of 37,306. Wall St is having a Kumbaya Xmas party and expects earnings growth of around 10% to 12% in 2024. They have completely lost their minds. But I digress.

From 2009 until today, the economy has been steadily dying. The Fed removed any sense of a free market by lowering interest rates below the hurdle rate. This has had the effect of mispricing businesses and assets. It had the effect of giving investors free money, which they could leverage, creating more stress on the financial system. It also allowed zombie corporations to keep their doors open even though they were insolvent, creating more stress on the financial system. This is what Keynes called an economic bubble, which only had one outcome: a bubble that would pop.

You can create an economic bubble in two ways. The first is to print money and expand the money supply. The second is to lower interest rates below the hurdle rate. The Fed has been doing both on and off since the 1980s. They have effectively destroyed the free market economy, created a highly leveraged economy, and a stressed financial system. It's the equivalent of a business that is constantly trying to find financing to keep its doors open, and its best-selling product has a bug it can't fix.

What the Reagan economic team (and all administration economic teams that followed) failed to recognize is that once you start blowing economic bubbles, there is no way out. It’s a trap. That trap has now played itself out. Well, not completely. We will now witness the Fed make one mistake after another over the next 2-3 years. Then, they will throw in the towel and default on a portion of our national debt, and also announce a currency reset.

Beginning in 2024, everyone will recognize that the once all-powerful Fed has become feckless and powerless. That there is nothing the Fed can do to fix the economy. The all-powerful Oz will be exposed.

Okay, let’s talk about the near term. The next significant economic event will be a sell-off in the stock market. I expect that to begin in Q1 and culminate in Q2 at around 3000 to 3300 on the S&P 500. Once we reach this bottom on the S&P, the Fed will begin cutting rates aggressively. However, it won’t work because this recession will begin to take hold. All of the financial leverage (and financial derivatives) will cause a banking crisis that won’t easily be rectified (like it was in March 2023). My target for year-end 2024 is 3500 (25% drop from here). And I expect the S&P to fall further in 2025 and 2026.

The economy is slowing. That is apparent. The stock market is at an all-time high, yet manufacturing PMIs are sub-50 (indicating retraction), LEIs (leading economic indicators) are terrible, shipping data is weak, autos and housing are reeling from high interest rates, retail is stagnant, banking is close to another crisis. With this backdrop, what is the stock market doing at ATHs? It’s insanity.

If those numbers aren't sufficient enough to convince you a recession is coming, consider this. Europe and Japan are already in recession, and China’s economy is struggling. Plus, US corporations get about 40% of their profits overseas. The dominos are clearly falling.

Interest rates have been inverted longer than at any point in my lifetime without a recession beginning. Is this time different? I doubt it. When does a stock market rise when a recession begins? Never. When does a stock market rise when the Fed lowers rates? Not often. When rates go down, it's usually not for a good reason.

Wall St is claiming (with their 10% earnings projections) that we are not going to have a recession. They think the Fed can lower rates and economic growth can continue. That possibility is a long shot at best, a more likely a needed miracle. Remember, the Fed is currently implementing QT and knows that inflation is still a problem. In Q1, when the stock market begins to falter, the Fed is not coming to the rescue with lower rates and money printing.

I know have not made my case yet for my opening paragraph. I have more to say.

Once this recession begins and the Fed is proven feckless and thereby cannot restart the economy, they will only have one option: print and keep rates as low as possible. However, too much printing will cause inflation. Also, they won’t be able to take rates back to zero, and they won’t be able to keep long-term rates low. The 10-Yr and 30-Yr bond rates will go higher than the Fed wants. This will further harm the economy.

The economy will begin to stagnate in 2024. Then, as time goes by, nothing the Fed tries will restart the economy. By the end of the decade, America will begin to fracture. States will begin to go their own way, ignoring Federal law and kicking Federal employees out of their State.

Bankruptcies will become common. Many corporations with household names that everyone knows will close their doors. Costs will soar for most items that we need, such as food, energy, shipping, insurance, etc. Conversely, asset prices will drop for things we want but can no longer afford, such as stocks, housing, autos, boats, RVs, etc.

2024 will be remembered by some as when the American era came to an end. It will actually be the beginning of the end. America in its current form will linger for a few more years. Then, it will quickly die to be replaced by new countries and new regions, all with new constitutions. Why will this happen? We will realize that there is only one option left: we have to do something different. The old way no longer works.

Here is the good news. Most of these new countries/regions will hold onto what America was cherished for: freedom and liberty. Those will be the foundations that we can build on. We have a bright future, albeit a difficult transition, and it begins in 2024.

Since this is an article of economic predictions, let’s end with some economic predictions for 2024 and beyond. These are my best guesses.

I think 2024 will be the year for gold/silver. My targets are $2300 for gold and $50 for silver, and I expect those targets to be exceeded by the end of 2024.

I expect the dollar (DXY) to rise when the stock market sell-off begins. My H1 target is 105 to 107, and then I expect a crash below 95 by year-end. In 2025, the dollar will crash to around 80, on its way to 70, as de-dollarization takes hold.

Oil will remain low the first half of the year ($60 to $75) as the recession takes hold, but should end the year above $80. In 2025, I expect oil to have a stellar year, reaching $125. Not because of economic growth, but because of a lack of global export supply. The energy crisis begins in 2025 or 2026.

The US budget deficit will reach $2.5T in 2024. This will cause the 10-Yr bond rate to jump from a low of 3.5% to 4.5% by year end. Long rates will go even higher in 2025.

Problem with making a claim that DXY will crash is that it is being compared to other currencies who have much bigger issues with their stagnant growth rates. US has AI, health care to drive forward their economy, EU, UK, Russia, Japan, China have much bigger problems with the falling growth rates. In fact their outlook is dreadful. Australia, Mexico , brazil and India have favorable growth trends going forward but none of them would account into the DXY analysis. If debt was the only issue then DXY would have crashed a while back. Any study needs to take a balanced approach.

Jacques de Larosiere makes exactly the same analysis